Personal Vehicle Mileage Rate 2025. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes. 65.5 cents per mile for business miles driven.

67 cents per mile for business purposes (up 1.5 cents from 2025). 65.5 cents per mile for business miles driven.

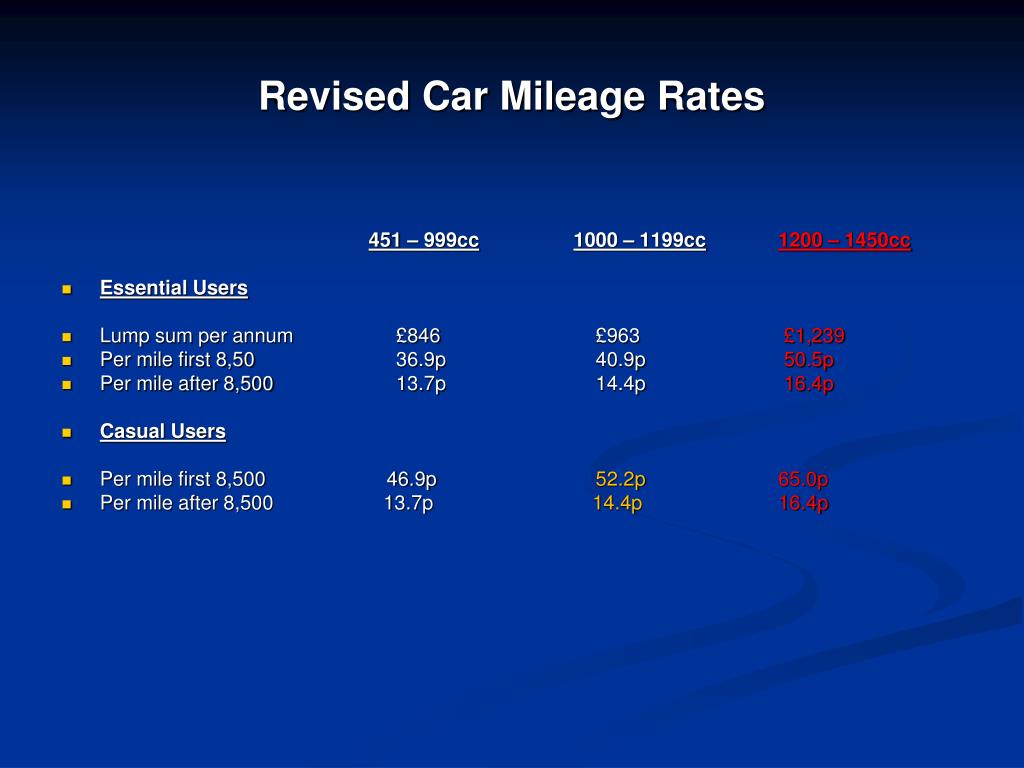

The attached document is classified by hmrc as guidance and contains information about rates and allowances for travel, including mileage and fuel allowances.

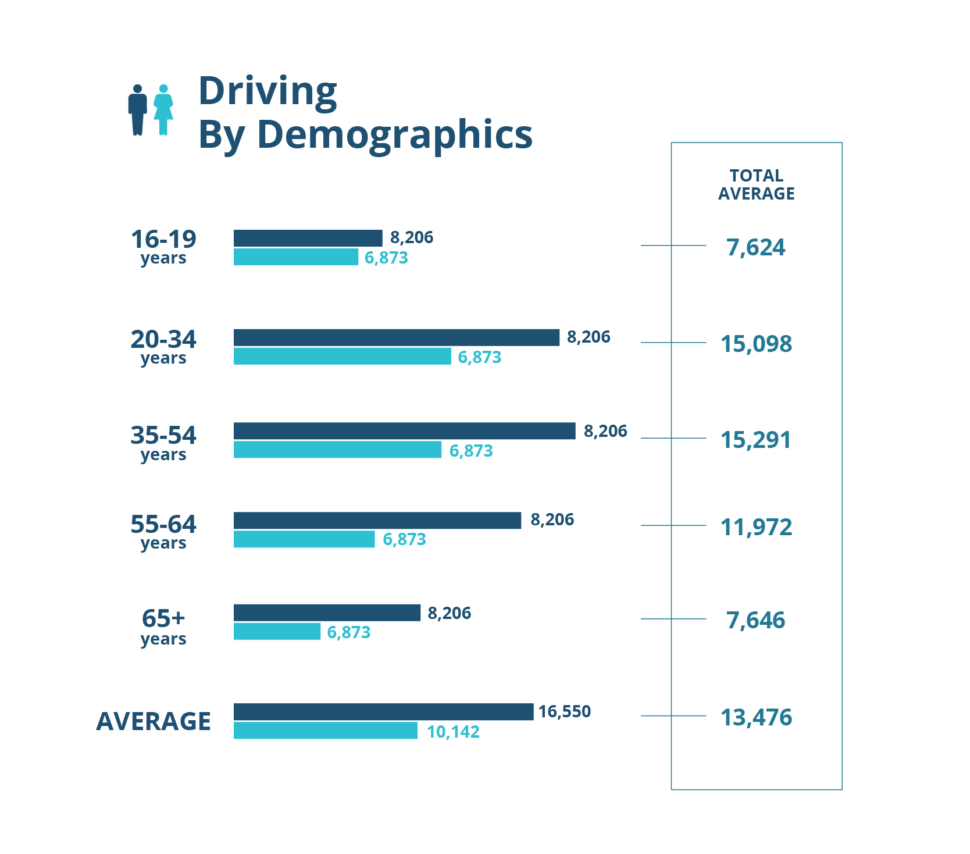

Average Miles Driven Per Year by State [Infographic, If you use your vehicle for both business and personal trips you will need to work out how to allocate costs correctly. Uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account.

Free Mileage Log Templates Smartsheet, The 2025/2025 kilometre rates have been published. You can find them on our website.

Understanding mileage rates and automobile reasonable allowance, It simplifies tracking by automatically using the correct irs standard. The standard mileage rate is 88 cents per kilometre for 2025/2025.

PPT Initial Consultation PowerPoint Presentation, free download ID, The standard mileage rates for the use of a car (also vans, pickups, or panel trucks) for 2025 are: 17 rows the standard mileage rates for 2025 are:

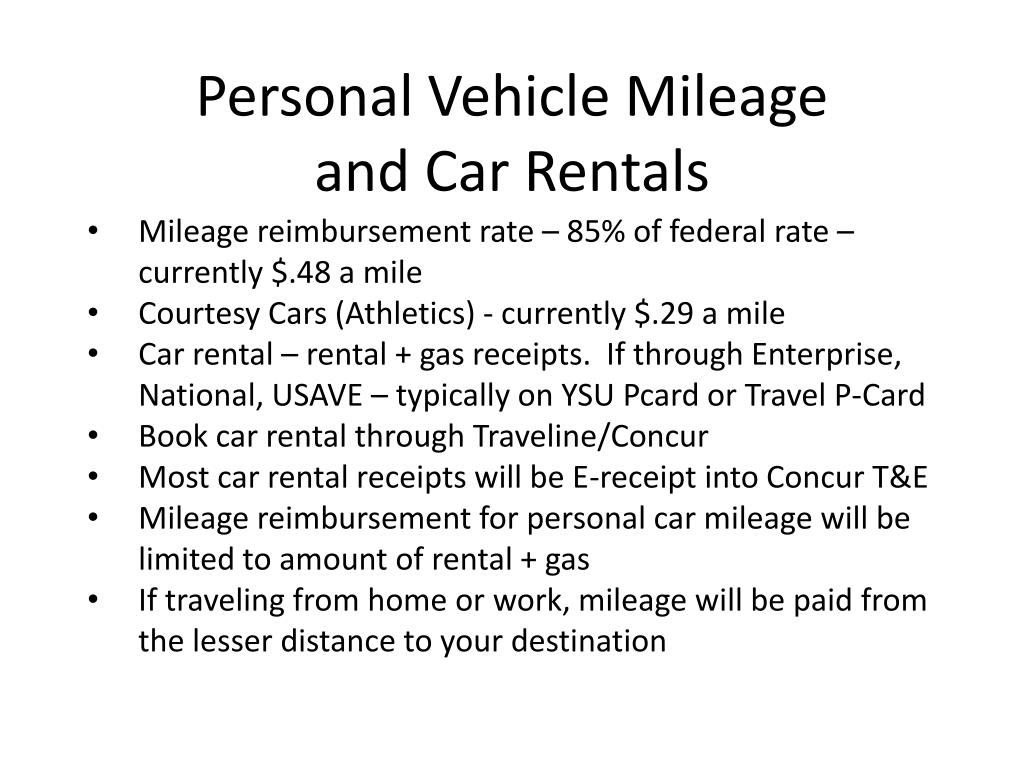

PPT TRAINING YSU TRAVEL GUIDE PowerPoint Presentation, free download, Uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account. Learn more about the cents per km 2025/2025 rate.

Business Math Calculating Mileage When Using a Personal Vehicle, Uses a rate that takes all your vehicle running expenses (including registration, fuel, servicing and insurance) and depreciation into account. Hybrid cars are treated as either petrol or diesel cars for advisory fuel.

Standard Mileage Rate Tax Deduction Explained! Save money on Taxes, 17 rows the standard mileage rates for 2025 are: The standard mileage deduction rose to 67 cents per mile, up 1.5 cents from 2025.

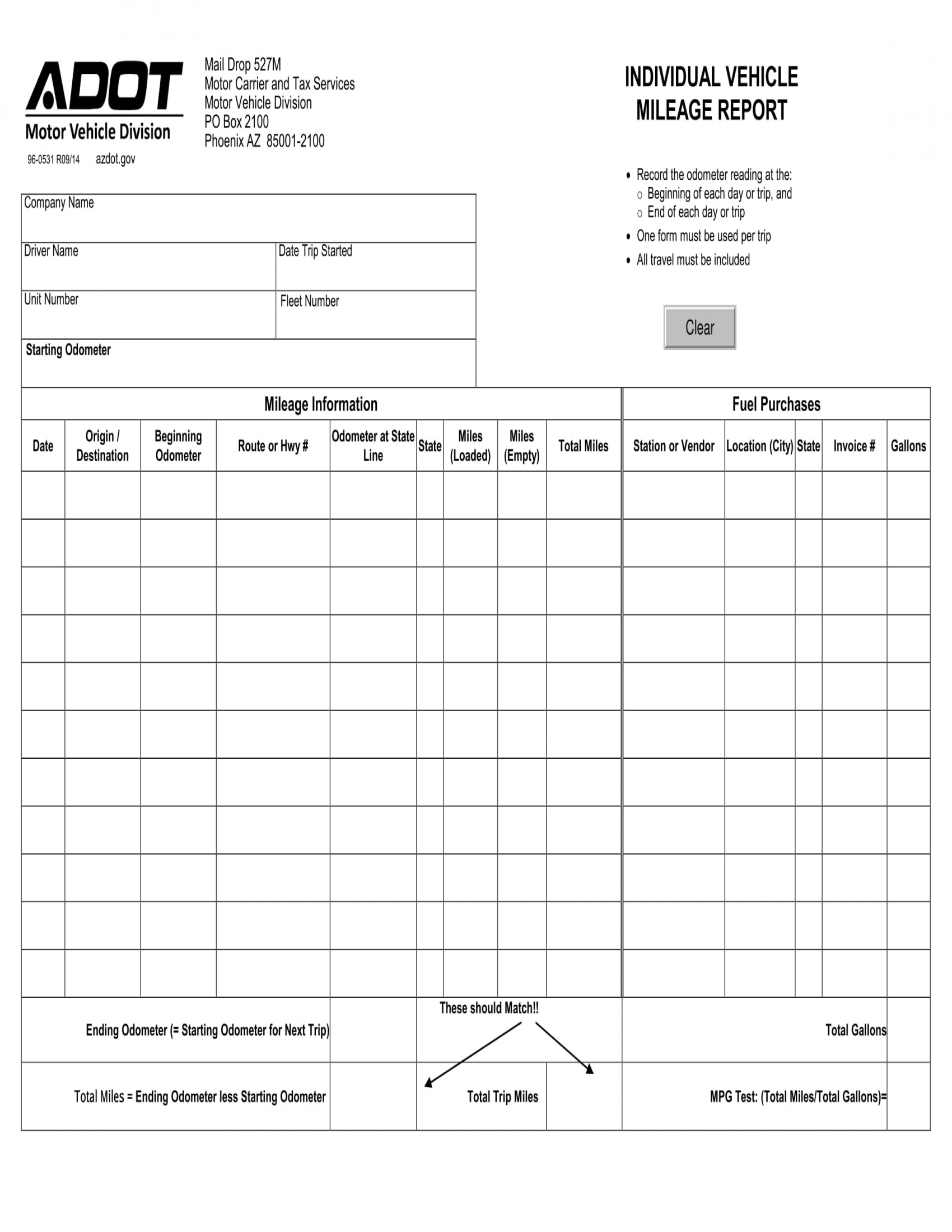

FREE 5+ Mileage Report Forms in MS Word PDF Excel, The attached document is classified by hmrc as guidance and contains information about rates and allowances for travel, including mileage and fuel allowances. It simplifies tracking by automatically using the correct irs standard.

All About Vehicle Mileage You Call We Haul, The attached document is classified by hmrc as guidance and contains information about rates and allowances for travel, including mileage and fuel allowances. The standard mileage rate is 88 cents per kilometre for 2025/2025.

Irs Electric Vehicle Mileage Rate In India Ina Cherise, To find your reimbursement, you multiply the number of kilometres by the rate: The standard mileage rate is 88 cents per kilometre for 2025/2025.

American Association Standings 2025. Enter your email address to receive updates on changes in rankings […]

Missouri Managed Deer Hunts 2025. Beginning july 1, deer hunters can apply online through the […]